- The House and Senate held a joint hearing with the tax-reform bill’s conferees to hash out the differences between the two chambers’ respective bills.

- Republicans reached an agreement before the hearing began, angering Democrats.

- The hearing became tense at times, with Democrats and Republicans engaging in shouting matches between one another.

WASHINGTON – Republicans moved their tax-reform bill along on Wednesday in one of the final steps before voting to pass the major overhaul of the federal tax code, while Democrats raged about elements of the bill and an inability to participate in the process.

Republicans and Democrats from both chambers joined together for the conference meeting on the Tax Cuts and Jobs Act in an effort to hash out the differences between the respective versions passed by the House and Senate. Only the singular bill had been completed and wrapped up ahead of the meeting.

The pre-conference meeting deal negotiated by Republicans, which included a handful of changes, enraged Democrats in the room, many of whom are committee ranking members and longtime tax writers.

Immediately after the hearing began, Rep. Lloyd Doggett of Texas motioned to postpone the hearing until Doug Jones could be seated after winning Alabama’s special election on Tuesday, a move Democrats began demanding earlier in the day. Kevin Brady, the chairman of the Ways and Means Committee, denied the motion and told Democrats that such motions were not an option on the table.

Democrats ripped Republicans for the exclusionary process

What ensued was repeated back and forth arguments between Republicans and Democrats about process and contents of the tax bill.

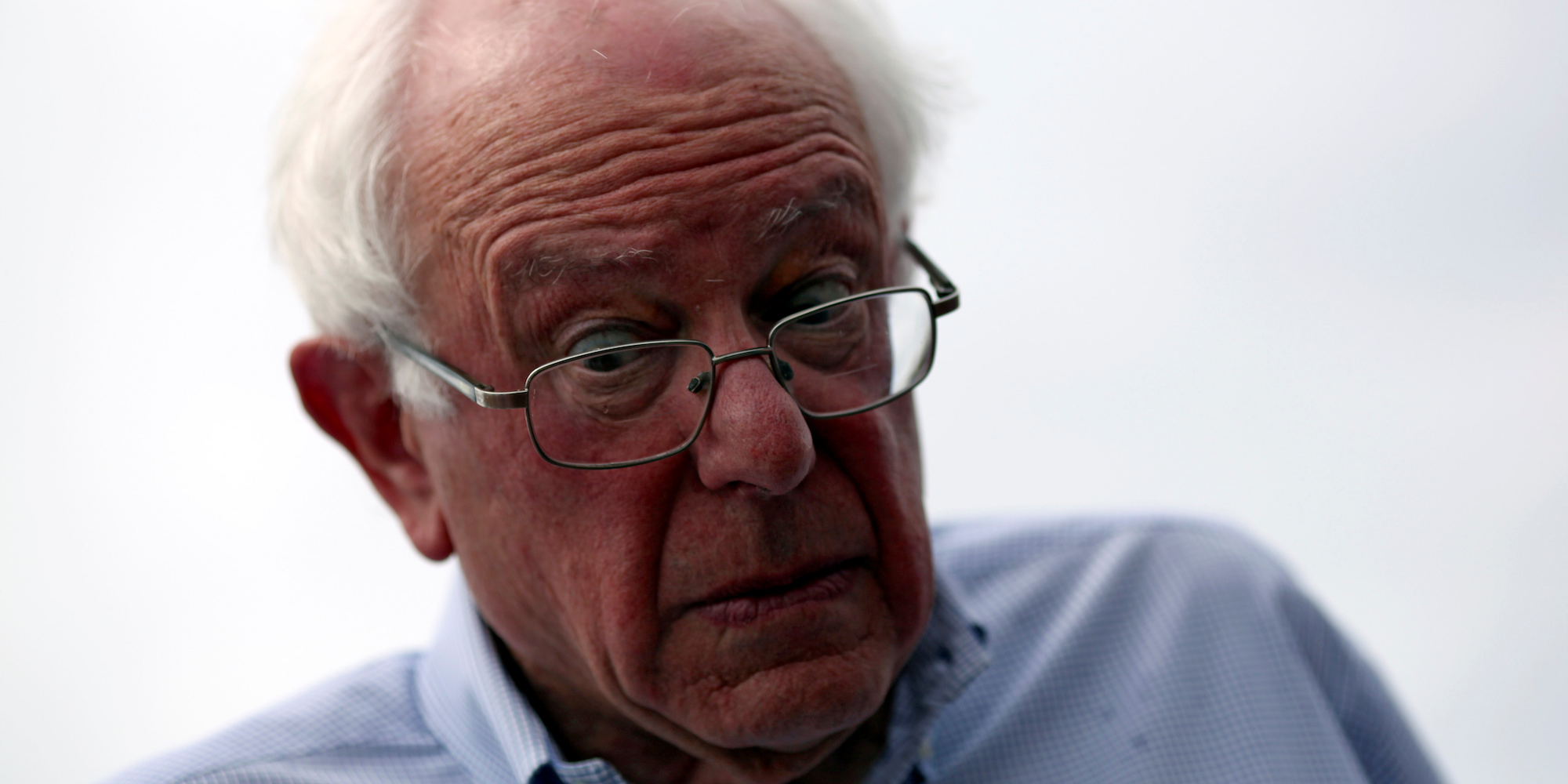

"This conference, so-called conference committee, is a farce," said Sen. Bernie Sanders, the top Democrat on the Budget Committee. "According to media reports, the final legislation has already been completed. This legislation, which will have a major impact on our economy, has not had one public hearing."

Senate Majority Whip John Cornyn shrugged off the notion that Democrats were excluded from the tax reform effort, saying, "They have voluntarily chosen not to participate in the process."

Republican Rep. Don Young snarked that he's glad he wore his cowboy boots.

"You know why cowboys wear cowboy boots?" he said. "To keep their damn pants clean from the horse manure that comes from people that don't know what the hell they're talking about."

Sen. Bob Menendez, a Democrat, quipped back at Young, "when you create the manure, you have to walk in it."

Outside the hearing room when Senate conferees briefly departed for votes, they lamented how the hearing was going, each blaming the other party.

Sen. Pat Toomey, a Pennsylvania Republican, said Democrats "chose to take themselves out of the room" adding, "that's unfortunate, but that's a reality that we faced."

But Democrats insisted the hearing was a sham.

"This is a reality-show version of a conference committee," Sen. Ron Wyden, the top Democrat on the Finance Committee, said. "We're talking about 10 trillion dollars worth of tax policy changes and that conference is not going to get to ask any questions about the real bill. I've been on a lot of conferences over the years. I have never seen one that's a bigger sham than this."

Across town, President Donald Trump delivered remarks on tax reform at the White House, highlighting families and workers who would benefit from the Republican plan.

"We'll have very little Democrat support, probably none, and that's purely for political reasons," Trump said. "They like it a lot, and they can't say it. They don't like what's happening. But they can't say it. Some day we have to come together and do bipartisan, and hopefully it can happen soon. Right?"

After much of the fighting subsided during each conferee's opening statements, lawmakers were given the chance to question Thomas Barthold, the chief of staff for the Joint Committee on Taxation.

Many lawmakers questioned the growth aspects of the bill, should it become law. Republicans hammered in that growth during the Obama administration was significantly lower than past levels in the decades following World War II.

Democrats put on their deficit hawk hats to inquire about what damage the minimal economic grow from the bill would do to the national debt.

Barthold noted that, per the JCT's own scoring of the tax plans, there would be a sizable boom in economic growth. However, such growth would not come close to paying for the cost of the $1.5 trillion slated to be cut.

Regardless of the bill's long term effects, it likely headed for the president's desk, potentially late next week.